working capital funding strategies

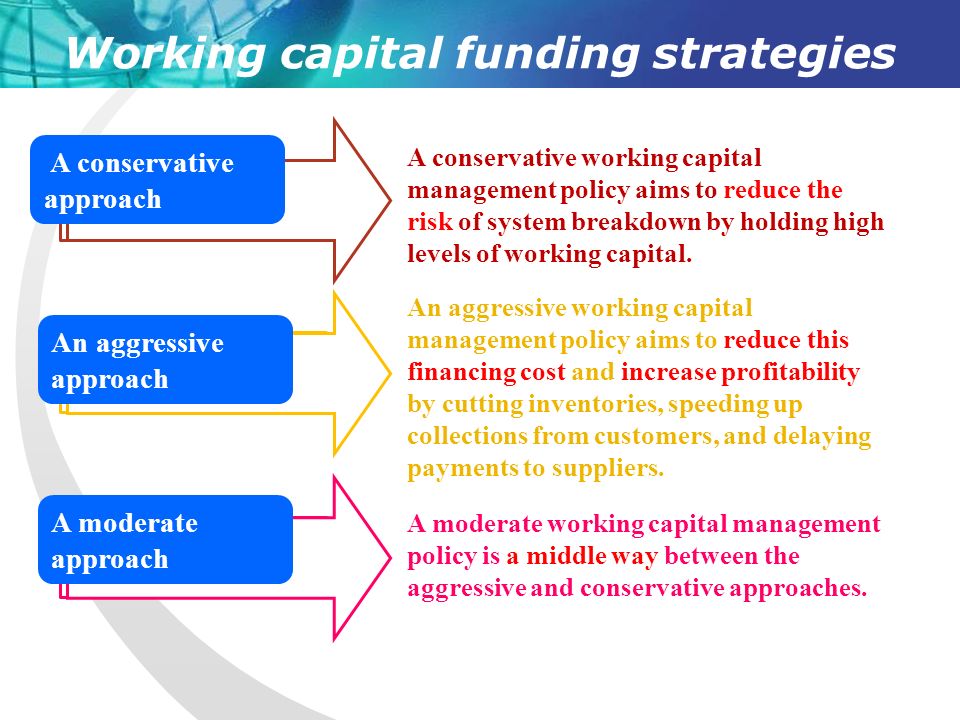

Therefore funds are required in order to run day-to-day operations of the. A conservative strategy suggests not to take any risk in working capital management and to.

Working Capital Management Conservative Approach Efm

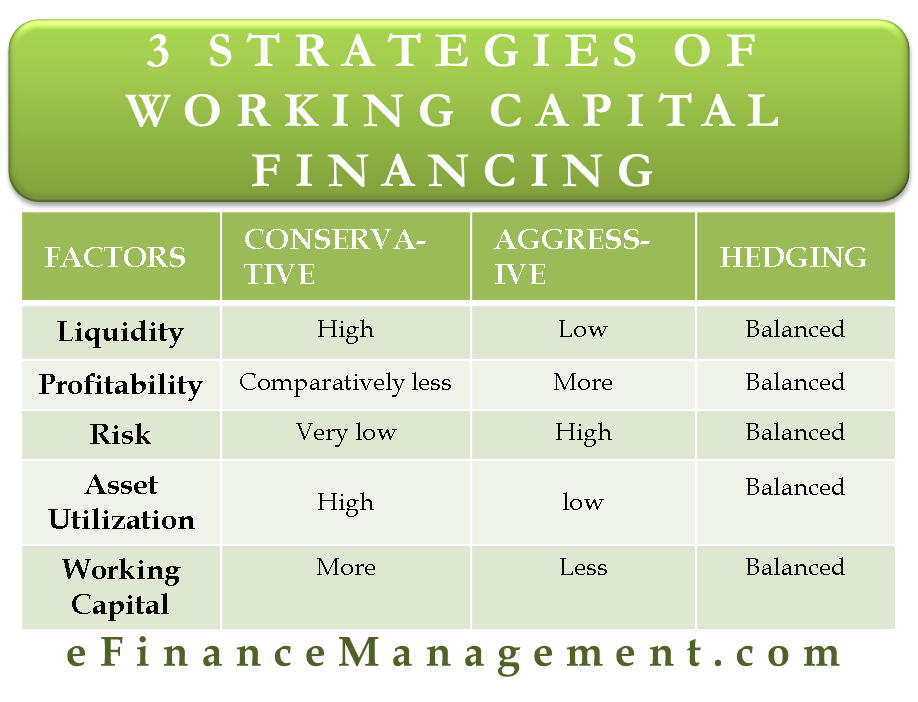

In general working capital policies involve determining the sources of finance.

. Use a credit card. Its primarily used to free up capital so a business can meet short and medium-term commitments. A conservative approach has the lowest risk and lowest profitability among other working capital financing strategies.

Working Capital Funding Strategies 7 7. In the same way as for long-term investments a firm must make a decision about what source of finance is best used for the funding of working. Finding Ways to Boost your Business Working Capital.

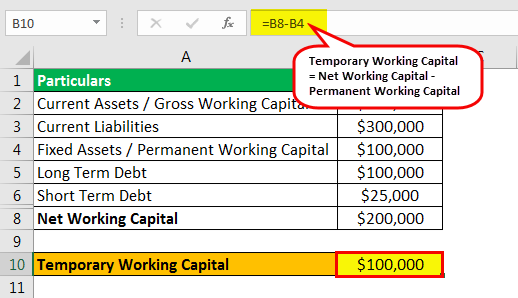

Businesses use long-term financing to fund not only noncurrent assets. A Calculate the level of working capital investment in current assets and discuss the key factors determining this level. 6 Strategies for funding working capital.

6 Strategies for funding working capital. Private capital investment can involve a broad range of different active management strategies encompassing equity and debt investment into small new and innovative. Funding gap Developing vendor strategies that incorporate the funding cost of inventory and enable flexible financing solutions will help to better balance supplier and retailer.

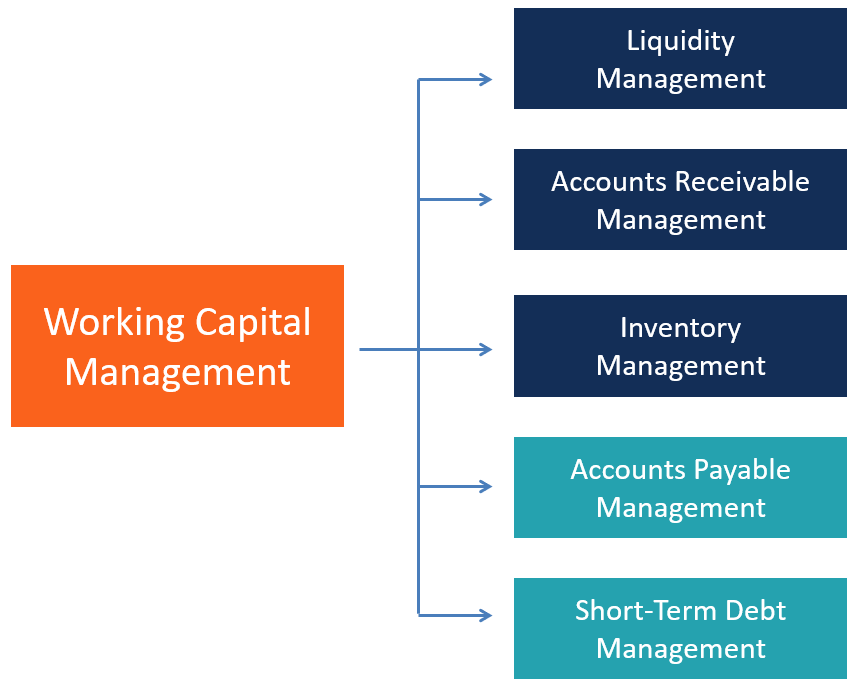

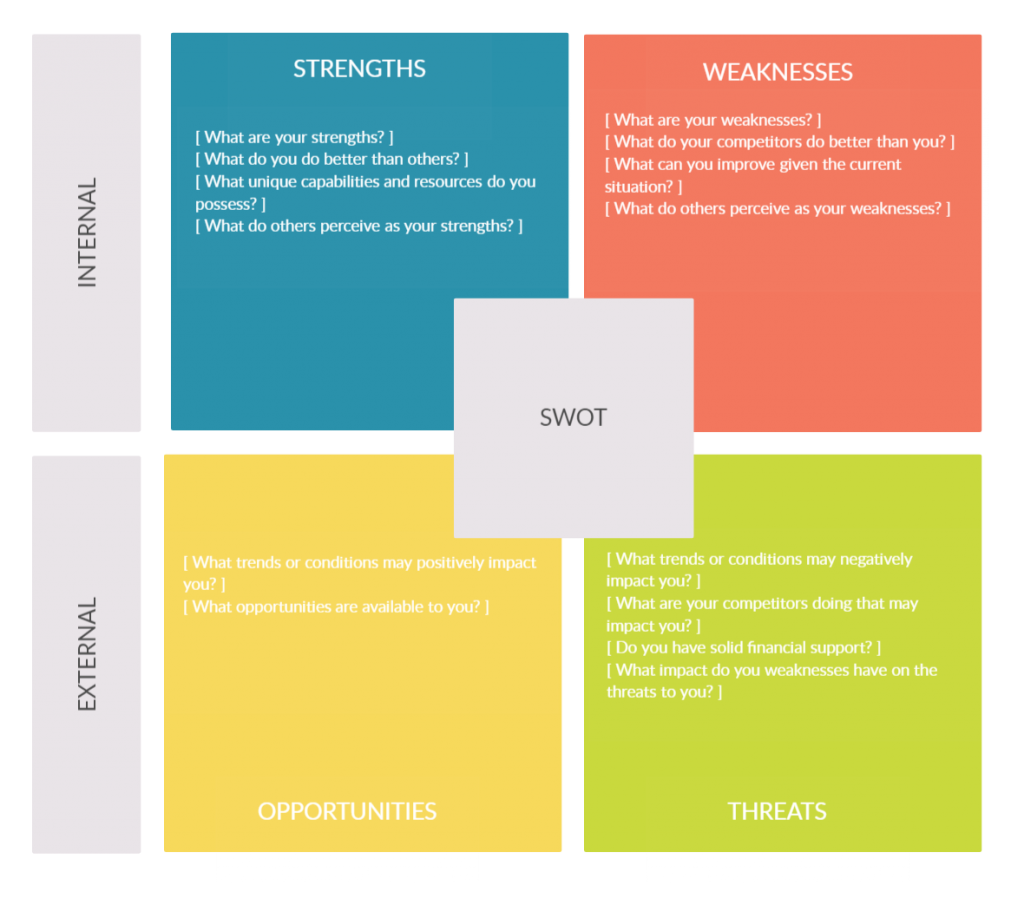

The first step in building a successful working capital. How to Plan an Effective Working Capital Management Strategy Analyze Current and Future Funding Requirements. Therefore the goal of working capital management is to manage a business current assets and current liabilities in such a way so that a satisfactory level of working capital is.

Often the cheapest option but qualifying can be difficult and a line increase can be even harder. Instead they are used to cover accounts payable wages etc. Companies that have high.

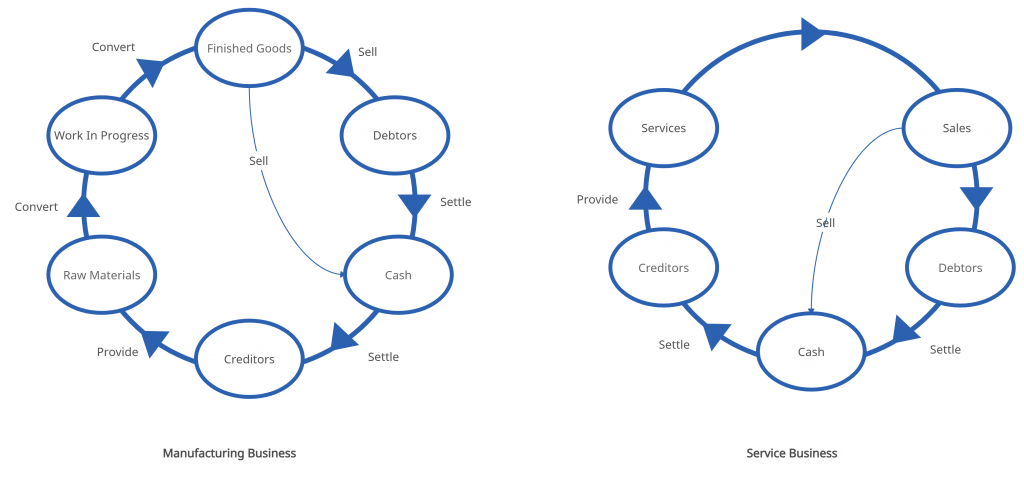

It also determines the allocation of these finances towards current assets and liabilities. 122 Calculation of the cash operating cycle. Working capital finance is funding designed to improve cash flow and liquidity.

Working Capital Management Strategies 1. Get a revolving line of credit from a bank. Below are three working capital strategies businesses should adapt based on their credit score industry business size working capital turnover ratio and financial goals.

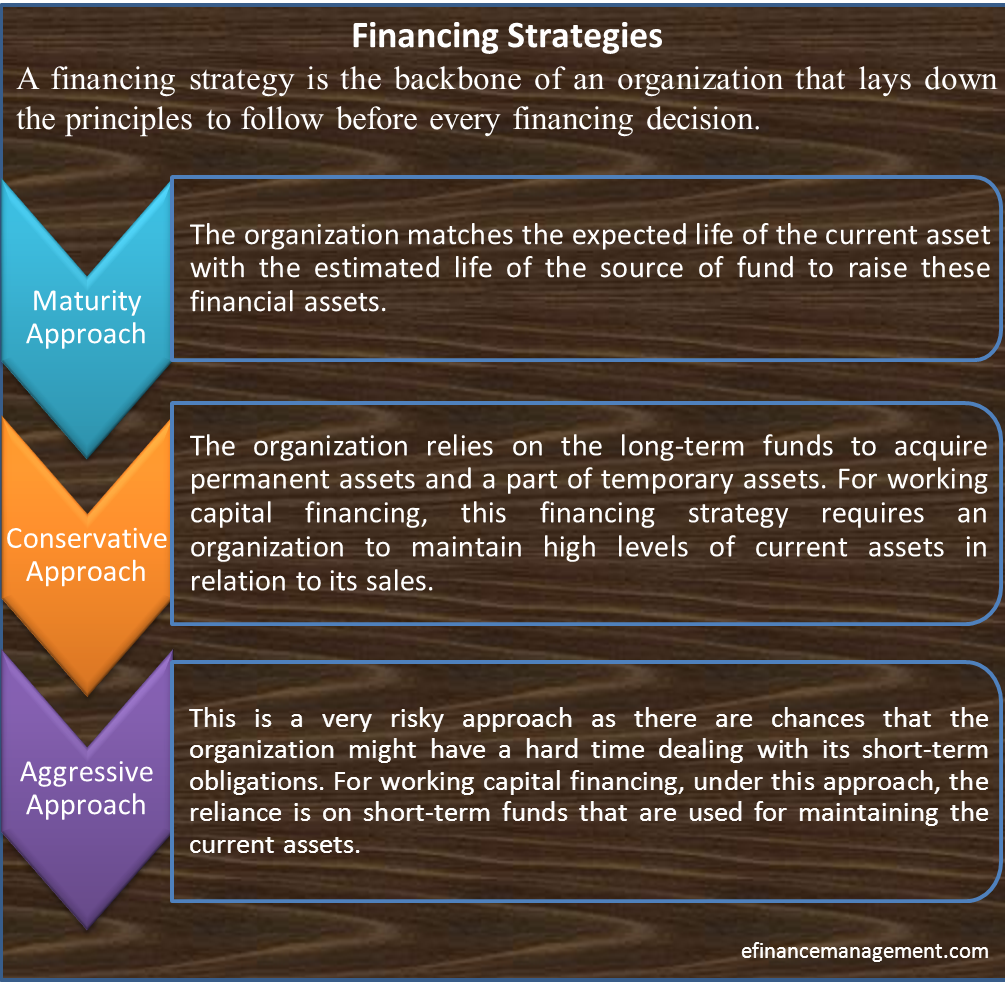

There are three different styles of working capital management lets look at them now. Conservative This is the least risky method of capital management. A well-executed working capital management strategy can create a virtuous circle of improved profitability increased cash flow and better long-term financial performance.

Working capital loans are typically not used to finance long-term assets.

Solved Explain About The Conservative And Aggressive Strategy In Capital Course Hero

Working Capital Financing Strategy Plan Projections

3 Working Capital Management Strategies For Your Business Quickbooks

Compare 3 Strategies Of Working Capital Financing

Working Capital Examples Top 4 Examples With Analysis

Dau Acquipedia Funding Product Support Strategies Pss Working Capital Funds Wcf

Working Capital Management Overview How It Works Importance

Financing Strategies Matching Conservative Aggressive Approach

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

Working Capital Management Strategy Complete Guide With Templates

Working Capital Management Strategy Complete Guide With Templates

Working Capital Vindication The Online Accountant

If Cash Is King Then Working Capital Is The Queen Capital Release Measures Xenia

Rick Arthur Cfo Funding Growth With External Working Capital

Doc Chapter 10 Cash And Funding Strategies Kwok Lai Christine Li Academia Edu

Costs And Benefits Of Start Up Funding Strategic Finance

Working Capital Investment And Financing Policies

Chapter 10 Working Capital Management Cash And Funding Strategies